2023 W-2 Info & FAQs

Here's info on your 2023 W-2. This information is available via a PDF in the attachments section of this page.

A Note from Right at School’s Payroll Team:

We’re finally done with 2023, hooray! With 2023 coming to a close, you can officially access your 2023 W-2 via your Paycom Employee Self-Service (ESS) Portal. While we’d love to help you through all of the details of your W-2, it’s best you ask this information to the IRS, a CPA, a tax accountant, or a certified tax professional. Legally, Right at School is unable to provide you with tax advice. We thank you for your understanding, and will always do our best to point you in the right direction without overstepping that legal boundary.

With that being said, we’ve put together a number of resources to help you navigate through your W-2, including:

- Steps for how to find your W-2 within your ESS portal

- Instructions for who to go to if you believe your W-2 is incorrect

- A list of W-2 FAQs

- Links to helpful websites & resources

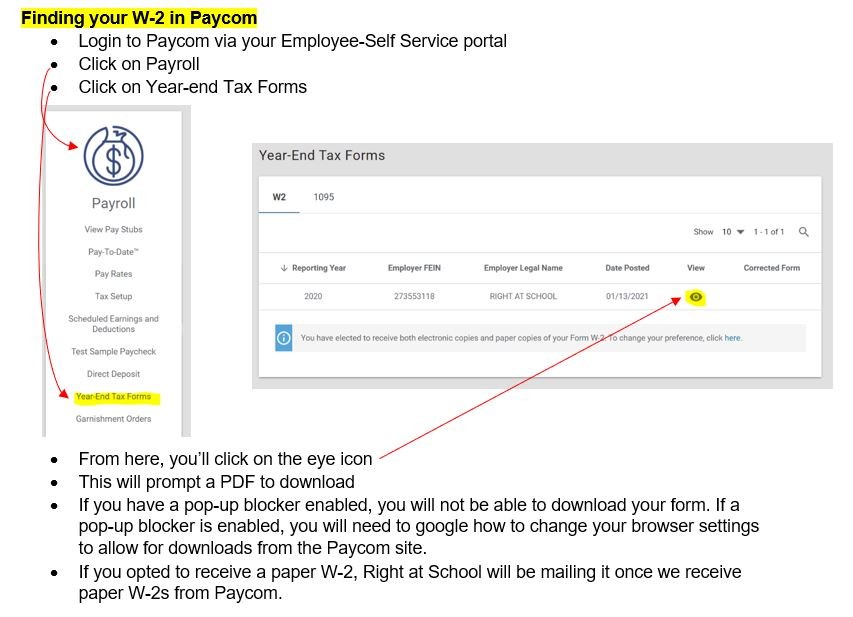

Finding your W-2 in Paycom

- Login to Paycom via your Employee-Self Service portal

- Click on Payroll

- Click on Year-end Tax Forms

Who do I Go to if I Believe My W-2 is Incorrect?

Great question! This answer depends on what you believe is incorrect. Follow the path (below) based on what you think is incorrect.

- Your Home Address – this is an informational field only & has no impact on you filing your W-2. You may leave this field as-is. Since this field does not impact your ability to file taxes, Right at School will not make any corrections to this item.

- Right at School’s Address – the address listed is the address of Right at School’s Central Office/Corporate office: 909 Davis St Ste 500 Evanston, IL. This is the address Right at School has on file with the IRS, which is why it is on your W-2. While you may work at a different location, this address is correct. Box 15 should show your true, work state

- Your Name – Your Area Manager or submit your question via the Ask Here portal in Paycom. You should always list your full, legal name within a company database

- Your Social Security Number - Submit your question via the Ask Here portal in Paycom. If your social security number is incorrect, you will not be able to file your taxes. Note: your Social Security Number transferred from your I-9, which was completed by you, so Right at School did not enter your social security number incorrectly

- Your Year-to-Date totals – Your W-2 shows calculations in the top right corner, which provide a breakdown of your W-2 information. Please look here first, as it will resolve most of your questions. For in-depth questions, please reach out to an accountant or CPA. If you believe you are missing a considerable amount of pay, please reach out to your Area Manager. Pay discrepancies must be handled by your direct supervisor since they handle your schedule & timesheet.

- Your Tax State - Submit your question via the Ask Here portal in Paycom

- Other/Not Listed Above - Submit your question via the Ask Here portal in Paycom

W-2 Frequently Asked Questions

- When can I expect to see my paper W-2 arrive?

- If you opted to receive a paper copy of your W-2, it will be stamped and mailed out prior to Wednesday 1/31/24.

- Per the IRS deadlines, Right at School had until 1/31/24 to mail out 2023 W-2s, so W-2s were actually mailed out earlier than the IRS deadline.

- Do you have a tracking number or tracking information for my W-2?

- W-2s were mailed via USPS first class mail, so there are no tracking numbers associated with them and Right at School has no way of knowing what day your W-2 will arrive at your home.

- Typically, USPS delivers mail within 5 business days, but delivery times fluctuate based on region. Please contact your local USPS branch for more information on your area.

- What is a Business day?

- Monday-Friday

- Regular business hours are typically 8am-5pm (in your local time zone)

- If W-2s were mailed out on Wednesday 1/31/24 and it typically takes 5-7 business days to receive paper mail, you should receive your W-2 around February 7th, 8th or 9th.

- Again, delivery times fluctuate based on region. Please contact your local USPS branch for more information on your area.

- I haven’t received my W-2 in the mail yet, what should I do?

- Check your Year-End Document preferences to see how you chose to receive your W-2. If you chose to receive your W-2 electronically, a paper W-2 will not be mailed to you.

- Instructions for viewing your year-end tax preferences are here:

- Link: https://wiki.rightatschool.com/books/payroll-help-for-employees/page/2020-w-2-info-faqs

- In the attachments section of this page, click “Show Me How – to Change My Year-End Tax Preferences and follow the steps on the document.

- Login to Paycom and pull your W-2 electronically. Your W-2 will always be available via download in your Paycom ESS profile.

- Your online W-2 will show which address your W-2 was sent to. If the address is old or incorrect, your paper W-2 may not make it to your home. Right at School sent out multiple notifications requesting employees update their address and personal information by 12/30/2023. W-2s were printed with the address, name, and social security number that you provided to Right at School. If your address is outdated, we suggest you download a copy of your W-2 and print it.

- Check your Year-End Document preferences to see how you chose to receive your W-2. If you chose to receive your W-2 electronically, a paper W-2 will not be mailed to you.

- I do not have access to a printer but I want a paper copy of my W-2.

- You will always have access to a copy of your W-2 via your Paycom Employee Self-Service profile. Employees who need a duplicate W-2 must utilize Paycom’s Employee Self-Service to view and print duplicate copies of their own W-2. If you do not have a printer, here are some local resources/ideas for printing:

- FedEx, UPS, Office Depot, Office Max, etc. all have printing services. It costs less than $0.50 to print a W-2 at these locations.

- If you file taxes online with somewhere like Turbo Tax, you don’t need to print a copy of your W-2. You simply have to upload your W-2 to their website.

- Local libraries or universities typically offer affordable or free printing solutions

- Your CPA/Accountant may allow you to print a copy of your W-2 at their office or send an electronic copy of your W-2 via a secure link.

- If you have a friend or family member with a printer, you can login to your ESS profile at their home and print a copy of your W-2 there

- Can’t you just send me a copy of my W-2 in an email?

- Privacy regulations prevent Right at School from emailing or faxing anyone a W-2.

- You will always have access to a copy of your W-2 via your Paycom Employee Self-Service profile. Employees who need a duplicate W-2 must utilize Paycom’s Employee Self-Service to view and print duplicate copies of their own W-2. If you do not have a printer, here are some local resources/ideas for printing:

- Why haven’t I received a response from the Ask Here team yet?

- We promise we are doing our best to accommodate your request. Our goal is to respond to each inquiry within 48-72 business The Ask Here portal is used by all 3,000+ Right at School employees, but is managed by 2 RAS employees, so it takes us a few days to address the volume of requests we receive. Note: urgent issues should be brought to your Area Manager’s attention. Ask Here should only be used for issues your Area Manager is unable to answer.

- I lost my W-2, what do I do?

- Good news! Digital copies of your W-2 will always be available online. Employees who need a duplicate W-2 must utilize Paycom’s Employee Self-Service to view and print duplicate copies of their own W-2. Please refer to the section “Finding your W-2 in Paycom” for more information on how to locate your digital W-2.

- What address did Right at School send my W-2 to?

-

- Right at School must adhere to all of Paycom’s deadlines and policies associated with W-2s. Paycom finalized 2023 W-2’s on 1/1/24, so whatever address you had listed in your Paycom Employee Self-Service portal on 12/31/23 is the address that will be printed on your W-2.

-

- Where is my prior year W-2?

- All 2023 W-2s live in Paycom in the Payroll > Year-End Tax Forms section of the site. If you’re looking for a prior year W-2, please reach out to payroll via the Ask Here portal in Paycom.

- How do I download my W-2 from Paycom?

- Please refer to the section “Finding your W-2 in Paycom” for more information on how to locate your digital W-2 & download it from your ESS portal.

- My wages on my W-2 do not match my final check stub of the year. What is the problem?

- The W-2 reflects taxable earnings while the check stubs reflect total earnings. To convert from total earnings to taxable earnings, you need to subtract the nontaxable deductions. Paycom was nice enough to show you these calculations. They’re located on the top, right corner of your W-2.

- What is this information in the top right corner of my W-2?

- The numbers listed in the top, right corner of your W-2 are the calculations used to get your final, W-2 taxable income. Paycom provides these as a courtesy to all Right at School employees. If you have questions on your W-2 Box 1, 2, 3, 4, 5, 6, 16, or 17 – this area should answer them.

- What information is included on my W-2?

- Your Form W-2 is a summary of the taxable earnings received in a calendar year. For the calendar year 2022, paychecks with a 2023 payout date are included on the 2023 W-2.

- The check for the pay period 12/24-1/6 is not included on my W-2. Is this correct?

- Yes, this is correct. The Form W-2 is issued on a cash basis. Any compensation paid to you in 2023 is considered 2023 income. The final days of December were paid on January 13, 2023 and is therefore not considered income for 2023. It will be part of your 2024 Form W-2.

- What if I didn’t have any federal or state taxes withheld according to my W-2?

- You would not have had any federal and state withholding taxes if you claimed an exemption from federal / state withholding on your W-4 form for the year (Employee’s Withholding Allowance Certificate). Check out your tax status through your Employee Self-Service portal. In addition, if your earnings are under a certain threshold, you may not have been subject to any federal and state withholding taxes. You can change your Employee Withholding Allowance Certificate to adjust your federal and state withholdings at any time.

- I can’t login to Paycom to download my W-2 – help! Who can I go to for login issues?

- If you are having trouble logging into Paycom, please reach out to your Primary Supervisor/Area Manager. They can provide you with your username & a temporary password so you can login to the site.

- My taxes look high, why is that?

- As a reminder, Right at School cannot provide you with tax advice. Most of your taxes are generated based on what you selected on your W-4. While we can provide you with a baseline of information, we always recommend you reach out to an accountant, CPA, or other tax professional for more information.

- Quick Facts for Tax Calculations:

- Social Security Tax = 6.2% of your taxable income

- Medicare Tax = 1.45% of your taxable income

- Federal Tax = based on what you selected on your W-4

- State & Local Tax = varies by state and region.

- My W-2 is not online/my W-2 is missing from my ESS portal, where is it?

- Did you make at least $600 in 2023?

- Did you get paid in 2023, meaning – did you receive a paycheck with the pay date falling in 2022?

- What do the codes mean in my Box 12?

- Please review the IRS website or the link below for more information on W-2, Box 12 codes. Link: https://www.hrblock.com/tax-center/irs/forms/understanding-form-w2-box-12-codes/

- Paycom’s website won’t let me download my W-2, can you help?

- If you have a pop-up blocker enabled, you will not be able to download your form. If a pop-up blocker is enabled, you will need to google how to change your browser settings to allow for downloads from the Paycom site. If you opted to receive a paper W-2, Right at School will be mailing it once we receive paper W-2s from Paycom. If you still need additional assistance with your download issue, please reach out to your Area Manager. Payroll and Tech cannot assist you with your personal device’s security settings.

Helpful Links & Resources

- Reading & Interpreting the Information on your W-2

- IRS Website

- Paycheck City, if you’d like to calculate what your 2021 paychecks will look like (varies slightly from Paycom)

- Tip: watch a YouTube video of how to read your W-2

.png)