Payroll help for Employees

- 2025 Payroll Calendar

- I didn't receive my direct deposit

- Where can I find my W-2 at the end of the year?

- 2024 W-2 Info & FAQs

- Direct Deposit Instructions - High Level & New Hires

- Direct Deposit Instructions - Detailed

- I can't clock-in or out of my school, can you help? (Apple iPhone Instructions)

- I can't clock in/out of my school, can you help? (Android Instructions)

- How will I get my first paycheck?

- What should I do if my check is lost or damaged?

- If I do not sign up for direct deposit, when will I get my paper check?

- Where can I find my electronic paystub & how do I print it?

- I think my paycheck is incorrect. What do I do?

- My address is incorrect or has changed. How do I update my address?

- What is a Punch Change Request and how do I submit one?

- I think my taxes are wrong

- How do I update my tax information?

- How do I request time off or view how much time off I have?

- Paycom Help Videos

- Who do I go to for help in Paycom?

- I received an email that told me to approve my timesheet. What does that mean?

- 2020 Payroll Calendar

- 2021 Payroll Calendar

- 2022 Payroll Calendar

- 2023 Payroll Calendar

- 2024 Payroll Calendar

2025 Payroll Calendar

2025 PAYROLL INFORMATION

I didn't receive my direct deposit

Direct deposits are sent out on Payday to the routing and account number you entered into Paycom. The processing times are variable for each financial institution, and RAS is unable to control how quickly the transaction is processed at your financial institution. It may not be deposited by your bank right away, especially if this is your first direct deposit from RAS.

Here are some steps that you can take right now to expedite the process of finding your direct deposit. Banks have extremely tight security, if RAS called in requesting information on your account, they would not be able to assist. The good news with this is that a lot of banks actually handle these kinds of issues internally....so if you entered in the wrong bank account number, the bank may be able help you out. I would recommend calling or visiting your financial institution in person and asking about this direct deposit. They will be able to tell you if the funds were returned or if there is another issue. You will also want to double check your account type, routing number and account number, and verify it matches what is in Paycom while speaking with them.

Normally, troubleshooting like this is significantly faster than a payroll company or an employer trying to resolve an issue. Whenever the account holder calls in, they can always get more information. Companies are typically denied assistance & the bank requests them to have the account holder/employee call in. If they were to give me your info, it would be a breach of their security.

If the funds have been rejected by your financial institution, they will be returned to RAS, typically within one week. Once RAS has received these funds back we will reach out to get them reissued to you.

Where can I find my W-2 at the end of the year?

W-2’s will be finalized by January 31st of each year. Login to the Paycom website or use the Paycom App to view your W-2. For more specific instructions use the guide attached in the sidebar of this page.

2024 W-2 Info & FAQs

Here's info on your 2024 W-2. This information is available via a PDF in the attachments section of this page.

A Note from Right at School’s Payroll Team:

We’re finally done with 2024, hooray! With 2024 coming to a close, you can officially access your 2024 W-2 via your Paycom Employee Self-Service (ESS) Portal. While we’d love to help you through all of the details of your W-2, it’s best you ask this information to the IRS, a CPA, a tax accountant, or a certified tax professional. Legally, Right at School is unable to provide you with tax advice. We thank you for your understanding, and will always do our best to point you in the right direction without overstepping that legal boundary.

With that being said, we’ve put together a number of resources to help you navigate through your W-2, including:

- Steps for how to find your W-2 within your ESS portal

- Instructions for who to go to if you believe your W-2 is incorrect

- A list of W-2 FAQs

- Links to helpful websites & resources

Finding your W-2 in Paycom

- Login to Paycom via your Employee-Self Service portal

- Click on Payroll

- Click on Year-end Tax Forms

Who do I Go to if I Believe My W-2 is Incorrect?

Great question! This answer depends on what you believe is incorrect. Follow the path (below) based on what you think is incorrect.

- Your Home Address – this is an informational field only & has no impact on you filing your W-2. You may leave this field as-is. Since this field does not impact your ability to file taxes, Right at School will not make any corrections to this item.

- Right at School’s Address – the address listed is the address of Right at School’s Central Office/Corporate office: 909 Davis St Ste 500 Evanston, IL. This is the address Right at School has on file with the IRS, which is why it is on your W-2. While you may work at a different location, this address is correct. Box 15 should show your true, work state

- Your Name – Your Area Manager or submit your question via the Ask Here portal in Paycom. You should always list your full, legal name within a company database

- Your Social Security Number - Submit your question via the Ask Here portal in Paycom. If your social security number is incorrect, you will not be able to file your taxes. Note: your Social Security Number transferred from your I-9, which was completed by you, so Right at School did not enter your social security number incorrectly

- Your Year-to-Date totals – Your W-2 shows calculations in the top right corner, which provide a breakdown of your W-2 information. Please look here first, as it will resolve most of your questions. For in-depth questions, please reach out to an accountant or CPA. If you believe you are missing a considerable amount of pay, please reach out to your Area Manager. Pay discrepancies must be handled by your direct supervisor since they handle your schedule & timesheet.

- Your Tax State - Submit your question via the Ask Here portal in Paycom

- Other/Not Listed Above - Submit your question via the Ask Here portal in Paycom

W-2 Frequently Asked Questions

- When can I expect to see my paper W-2 arrive?

- If you opted to receive a paper copy of your W-2, it will be stamped and mailed out prior to Thursday 1/31/25.

- Per the IRS deadlines, Right at School has until 1/31/25 to mail out 2024 W-2s, so W-2s will be mailed out earlier than the IRS deadline.

- Do you have a tracking number or tracking information for my W-2?

- W-2s were mailed via USPS first class mail, so there are no tracking numbers associated with them and Right at School has no way of knowing what day your W-2 will arrive at your home.

- Typically, USPS delivers mail within 5 business days, but delivery times fluctuate based on region. Please contact your local USPS branch for more information on your area.

- What is a Business day?

- Monday-Friday

- Regular business hours are typically 8am-5pm (in your local time zone)

- If W-2s were mailed out on Thursday 1/31/24 and it typically takes 5-7 business days to receive paper mail, you should receive your W-2 around February 7th, 8th or 9th.

- Again, delivery times fluctuate based on region. Please contact your local USPS branch for more information on your area.

- I haven’t received my W-2 in the mail yet, what should I do?

-

- Instructions for viewing your year-end tax preferences are here:Check your Year-End Document preferences to see how you chose to receive your W-2. If you chose to receive your W-2 electronically, a paper W-2 will not be mailed to you.

- In the attachments section of this page, click “Show Me How – to Change My Year-End Tax Preferences and follow the steps on the document.

- Login to Paycom and pull your W-2 electronically. Your W-2 will always be available via download in your Paycom ESS profile.

- Your online W-2 will show which address your W-2 was sent to. If the address is old or incorrect, your paper W-2 may not make it to your home. Right at School sent out multiple notifications requesting employees update their address and personal information by 12/31/2024. W-2s were printed with the address, name, and social security number that you provided to Right at School. If your address is outdated, we suggest you download a copy of your W-2 and print it.

-

- I do not have access to a printer but I want a paper copy of my W-2.

- You will always have access to a copy of your W-2 via your Paycom Employee Self-Service profile. Employees who need a duplicate W-2 must utilize Paycom’s Employee Self-Service to view and print duplicate copies of their own W-2. If you do not have a printer, here are some local resources/ideas for printing:

- FedEx, UPS, Office Depot, Office Max, etc. all have printing services. It costs less than $0.50 to print a W-2 at these locations.

- If you file taxes online with somewhere like Turbo Tax, you don’t need to print a copy of your W-2. You simply have to upload your W-2 to their website.

- Local libraries or universities typically offer affordable or free printing solutions

- Your CPA/Accountant may allow you to print a copy of your W-2 at their office or send an electronic copy of your W-2 via a secure link.

- If you have a friend or family member with a printer, you can login to your ESS profile at their home and print a copy of your W-2 there

- Can’t you just send me a copy of my W-2 in an email?

- Privacy regulations prevent Right at School from emailing or faxing anyone a W-2.

- You will always have access to a copy of your W-2 via your Paycom Employee Self-Service profile. Employees who need a duplicate W-2 must utilize Paycom’s Employee Self-Service to view and print duplicate copies of their own W-2. If you do not have a printer, here are some local resources/ideas for printing:

- Why haven’t I received a response from the Ask Here team yet?

- We promise we are doing our best to accommodate your request. Our goal is to respond to each inquiry within 48-72 business The Ask Here portal is used by all 4,000+ Right at School employees, but is managed by 2 RAS employees, so it takes us a few days to address the volume of requests we receive. Note: urgent issues should be brought to your Area Manager’s attention. Ask Here should only be used for issues your Area Manager is unable to answer.

- I lost my W-2, what do I do?

- Good news! Digital copies of your W-2 will always be available online. Employees who need a duplicate W-2 must utilize Paycom’s Employee Self-Service to view and print duplicate copies of their own W-2. Please refer to the section “Finding your W-2 in Paycom” for more information on how to locate your digital W-2.

- What address did Right at School send my W-2 to?

-

- Right at School must adhere to all of Paycom’s deadlines and policies associated with W-2s. Paycom finalized 2024 W-2’s on 1/1/25, so whatever address you had listed in your Paycom Employee Self-Service portal on 12/31/24 is the address that will be printed on your W-2.

-

- Where is my prior year W-2?

- All 2024 W-2s live in Paycom in the Payroll > Year-End Tax Forms section of the site. If you’re looking for a prior year W-2, please reach out to payroll via the Ask Here portal in Paycom.

- How do I download my W-2 from Paycom?

- Please refer to the section “Finding your W-2 in Paycom” for more information on how to locate your digital W-2 & download it from your ESS portal.

- My wages on my W-2 do not match my final check stub of the year. What is the problem?

- The W-2 reflects taxable earnings while the check stubs reflect total earnings. To convert from total earnings to taxable earnings, you need to subtract the nontaxable deductions. Paycom was nice enough to show you these calculations. They’re located on the top, right corner of your W-2.

- What is this information in the top right corner of my W-2?

- The numbers listed in the top, right corner of your W-2 are the calculations used to get your final, W-2 taxable income. Paycom provides these as a courtesy to all Right at School employees. If you have questions on your W-2 Box 1, 2, 3, 4, 5, 6, 16, or 17 – this area should answer them.

- What information is included on my W-2?

- Your Form W-2 is a summary of the taxable earnings received in a calendar year. For the calendar year 2022, paychecks with a 2024 payout date are included on the 2024 W-2.

- The check for the pay period 12/24-1/6 is not included on my W-2. Is this correct?

- Yes, this is correct. The Form W-2 is issued on a cash basis. Any compensation paid to you in 2024 is considered 2024 income. The final days of December were paid on January 10, 2025 and is therefore not considered income for 2024. It will be part of your 2025 Form W-2.

- What if I didn’t have any federal or state taxes withheld according to my W-2?

- You would not have had any federal and state withholding taxes if you claimed an exemption from federal / state withholding on your W-4 form for the year (Employee’s Withholding Allowance Certificate). Check out your tax status through your Employee Self-Service portal. In addition, if your earnings are under a certain threshold, you may not have been subject to any federal and state withholding taxes. You can change your Employee Withholding Allowance Certificate to adjust your federal and state withholdings at any time.

- I can’t login to Paycom to download my W-2 – help! Who can I go to for login issues?

- If you are having trouble logging into Paycom, please reach out to your Primary Supervisor/Area Manager. They can provide you with your username & a temporary password so you can login to the site.

- My taxes look high, why is that?

- As a reminder, Right at School cannot provide you with tax advice. Most of your taxes are generated based on what you selected on your W-4. While we can provide you with a baseline of information, we always recommend you reach out to an accountant, CPA, or other tax professional for more information.

- Quick Facts for Tax Calculations:

- Social Security Tax = 6.2% of your taxable income

- Medicare Tax = 1.45% of your taxable income

- Federal Tax = based on what you selected on your W-4

- State & Local Tax = varies by state and region.

- My W-2 is not online/my W-2 is missing from my ESS portal, where is it?

- Did you make at least $600 in 2024?

- Did you get paid in 2024, meaning – did you receive a paycheck with the pay date falling in 2024?

- What do the codes mean in my Box 12?

- Please review the IRS website or the link below for more information on W-2, Box 12 codes. Link: https://www.hrblock.com/tax-center/irs/forms/understanding-form-w2-box-12-codes/

- Paycom’s website won’t let me download my W-2, can you help?

- If you have a pop-up blocker enabled, you will not be able to download your form. If a pop-up blocker is enabled, you will need to google how to change your browser settings to allow for downloads from the Paycom site. If you opted to receive a paper W-2, Right at School will be mailing it once we receive paper W-2s from Paycom. If you still need additional assistance with your download issue, please reach out to your Area Manager. Payroll and Tech cannot assist you with your personal device’s security settings.

Helpful Links & Resources

- Reading & Interpreting the Information on your W-2

- IRS Website

- Paycheck City, if you’d like to calculate what your 2021 paychecks will look like (varies slightly from Paycom)

- Tip: watch a YouTube video of how to read your W-2

Direct Deposit Instructions - High Level & New Hires

Direct Deposit is a benefit available to every employee and is highly encouraged, so you can receive your paycheck on Right At School’s Paydate. To add or edit your direct deposit information login to the Paycom website or use the Paycom App on your phone.

If you enter or edit your direct deposit information by end of day on the Monday before pay day your next check will be direct deposited. If you enter it after that date it will take until the next paycheck when it is effective.

Follow the attached instructions if you need more guidance. They are also displayed below

Direct Deposit Instructions - Detailed

Direct Deposit Setup in Paycom

- Are you a new employee or is this your 1st time setting up a direct deposit with Right at School? Follow instructions on this page in the Right at School Wiki - CLICK HERE

- For best results, we recommend using the Paycom App

- Are you trying to change your existing direct deposit information? Follow the instructions below. Instructions differ for the computer & the Paycom app, so we’ve included both

Desktop/Computer Instructions

To get to the direct deposit screen, click Payroll

- Then click Direct Deposit

- Do you have more than one bank account set-up?

- If NO, then you will only be editing the section titled “Main Account – Net Pay.”

- Within this section, follow these steps:

- Click Clear Fields

- Enter in your new banking information, which includes:

- Account Type

- Routing Number

- Account Number

- Bank Name

- Scroll to the bottom

- Check the box to the left of the message, “by selecting this check box and clicking Update, I have agreed to the terms within the Direct Deposit Authorization Agreement

- Click the box that says, “CLICK HERE TO SIGN AS EMPLOYEE”

- Click Update – changes will not be applied unless you complete ALL three of these items:

- Check the box

- Sign as an employee

- Click the update button

-

If YES

Are you trying to update your main bank account or one of your distribution bank accounts?

A - Main Account only

you will only be editing the section titled “Main Account – Net Pay

-

- Within this section, follow these steps:

- Click Clear Fields

- Enter in your new banking information, which includes:

- Account Type

- Routing Number

- Account Number

- Bank Name

- Scroll to the bottom

- Check the box to the left of the message, “by selecting this check box and clicking Update, I have agreed to the terms within the Direct Deposit Authorization Agreement

- Click the box that says, “CLICK HERE TO SIGN AS EMPLOYEE”

- Click Update – changes will not be applied unless you complete ALL three of these items:

- Check the box

- Sign as an employee

- Click the update button

B - One (or more) of your Distribution Bank accounts only:

- Within this section, follow these steps:

- Leave your “Main Account – Net Pay” section as is. Do not make any changes here

- Scroll down to the Direct Deposit Distributions section of the page

-

- Click Edit Distributions on the right side of the screen. Until you click this button, you will not be able to modify your information

- Enter in your new banking information, which includes:

- Account Type

- Routing Number

- Account Number

- Bank Name

- Repeat this process for every distribution account you want to update.

- Once you’ve updated everything you needed to, scroll to the bottom of the page

- Check the box to the left of the message, “by selecting this check box and clicking Update, I have agreed to the terms within the Direct Deposit Authorization Agreement

- Click the box that says, “CLICK HERE TO SIGN AS EMPLOYEE”

- Click Update – changes will not be applied unless you complete ALL three of these items:

- Check the box

- Sign as an employee

- Click the update button

C - Both your Main Account AND your distribution bank accounts

- Follow the instructions in sections A and B, which are highlighted in green

-

-

- Within this section, follow these steps:

I can't clock-in or out of my school, can you help? (Apple iPhone Instructions)

If you're unable to clock in/out at your school, you're probably experiencing an issue with your Location Services. To clock in/out successfully, you must have Location Services turned on within your Phone Settings AND the Paycom App. If you do not have location services turned on for the Paycom App, you will always receive an error when you try to clock in or out.

*Note* If you are in program and need to be clocked in ASAP, please use another team member's device. Just make sure their device is set up correctly for clocking in/out.

The instructions below are for how to turn on Location Services in the Paycom App:

I can't clock in/out of my school, can you help? (Android Instructions)

If you're unable to clock in/out at your school, you're probably experiencing an issue with your Location Services. To clock in/out successfully, you must have Location Services turned on within your Phone Settings AND the Paycom App. If you do not have location services turned on for the Paycom App, you will always receive an error when you try to clock in or out.

*Note* If you are in program and need to be clocked in ASAP, please use another team member's device. Just make sure their device is set up correctly for clocking in/out.

The instructions below are for how to turn on Location Services in the Paycom App on an Andriod device:

How will I get my first paycheck?

If you enter your direct deposit information prior to the Monday before your first pay check it will be direct deposited. If not, your check will be mailed to the address on file.

To review or edit the address that is on file please go to the Paycom website or use the Paycom App on your phone and follow the attached instructions in the side bar of this page.

What should I do if my check is lost or damaged?

If your check is lost or damaged please reach out to your Area Manager to notify them of the issue. If you don't hear back from your Area Manager and/or need additional assistance, you may submit your concern to Payroll via the Ask Here feature in Paycom. Instructions on how to submit an Ask Here request are attached in the side bar of this page.

When submitting an Ask Here request please be sure the include the check date that you are missing as well as any other relevant information.

The reissue will take three business days to process plus mailing time.

If I do not sign up for direct deposit, when will I get my paper check?

All paper Paychecks are put in the mail on Right At School’s pay dates, and sent via USPS. Postal delivery takes up to eight business days. Depending on where people are located in the US, the weather, holidays, etc. If you have not received your check and it has been longer than 8 business days, please reach out to your area manager.

If you don't hear back from your Area Manager and/or need additional assistance, you may submit your concern to Payroll via the Ask Here feature in Paycom. submit an Ask Here request via Paycom to request a replacement check.

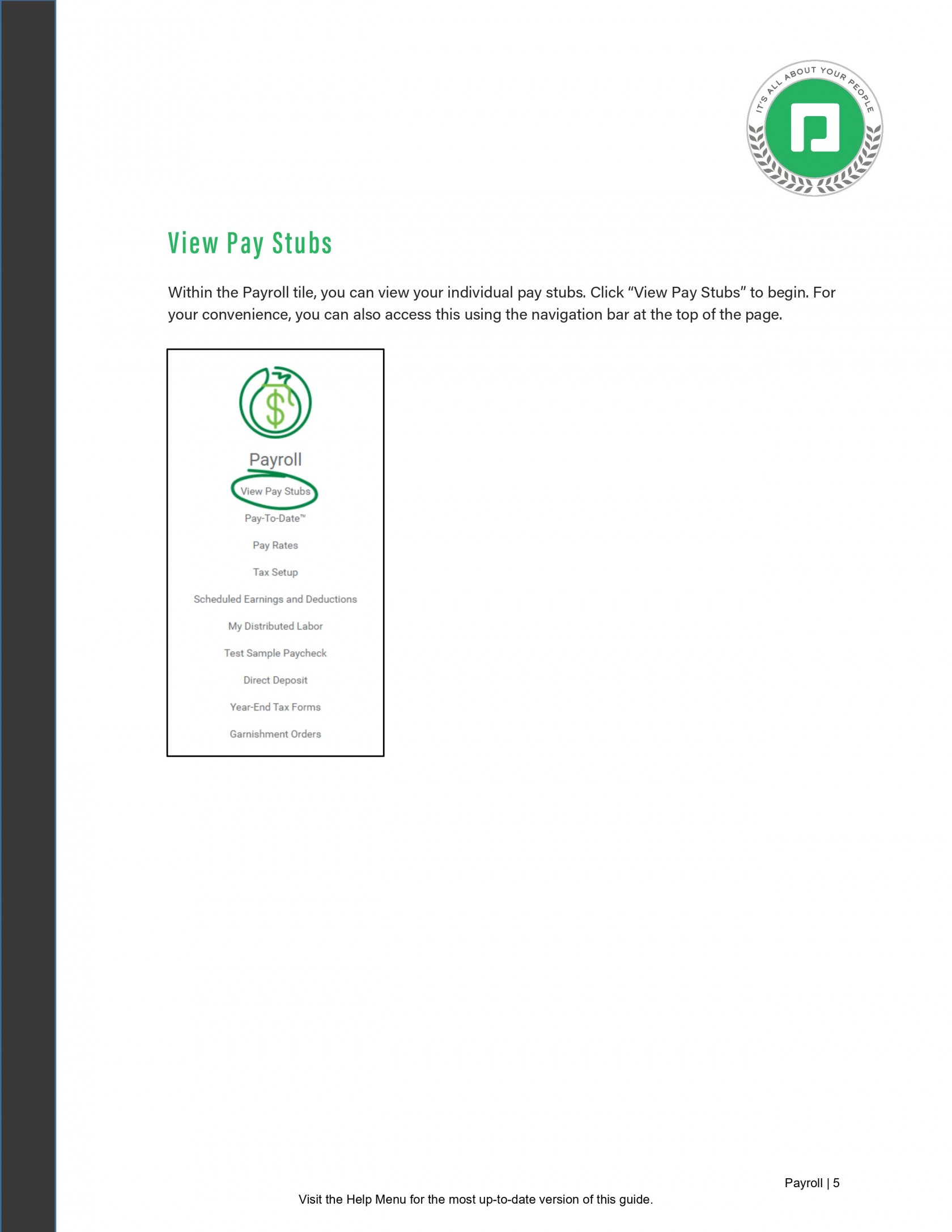

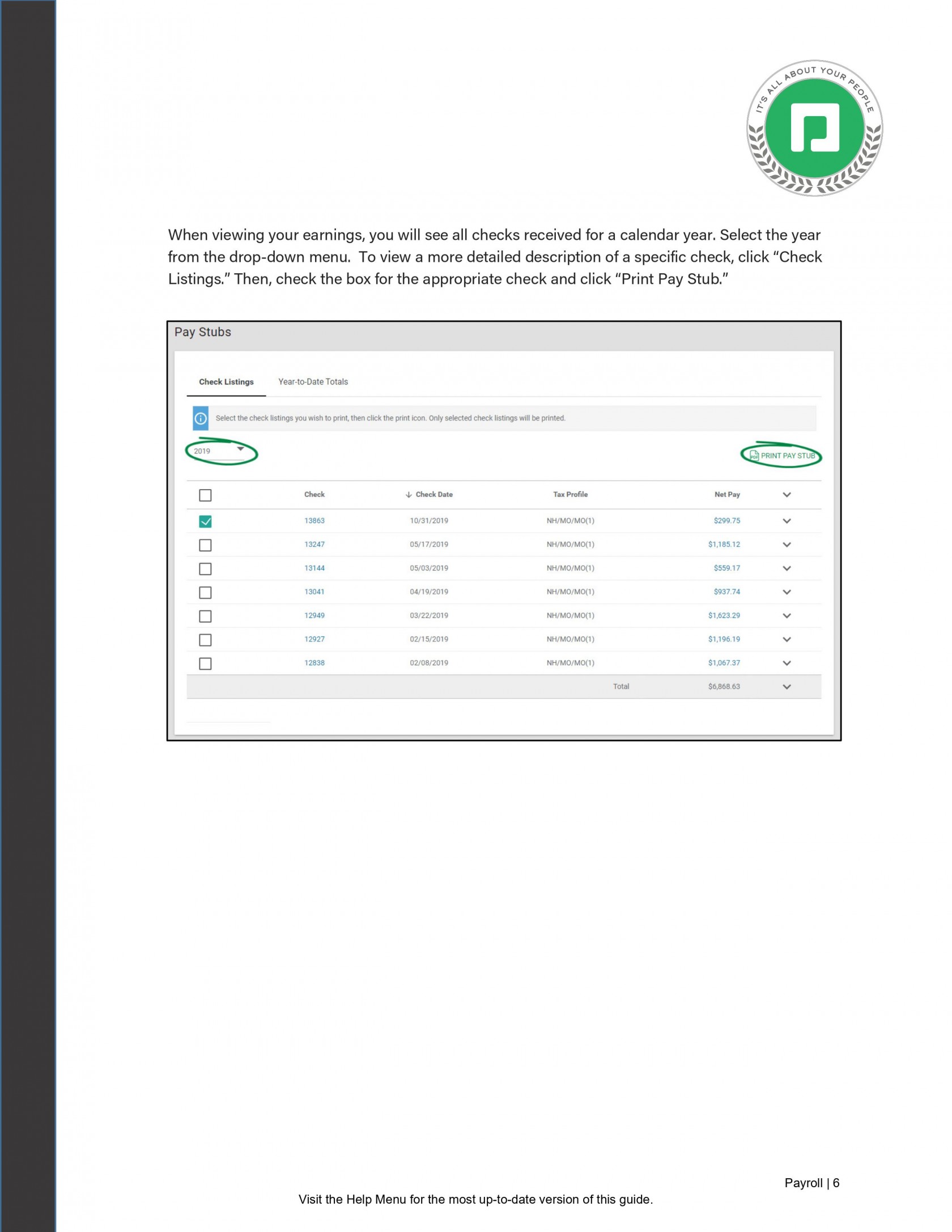

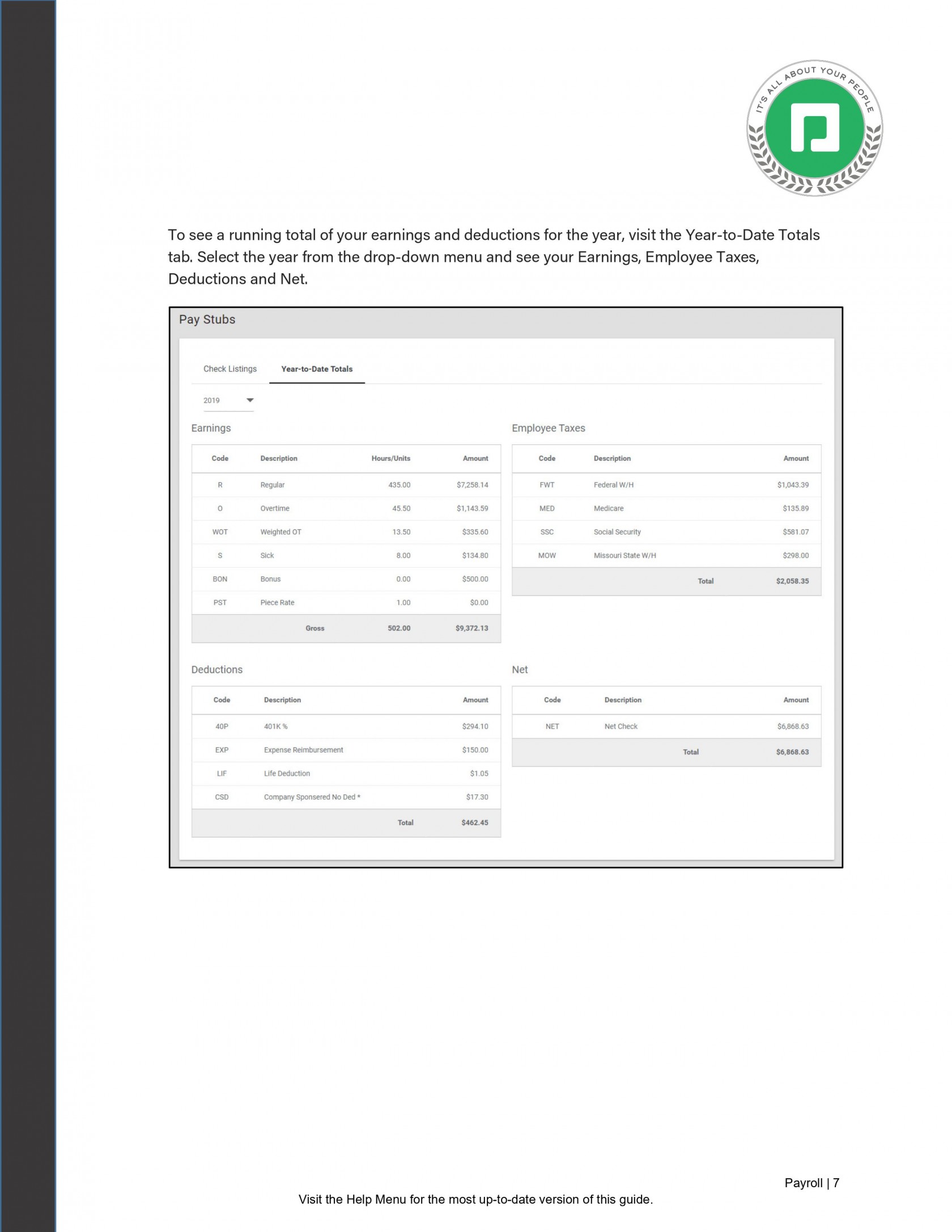

Where can I find my electronic paystub & how do I print it?

To view your paystub login to the Paycom Website or use the Paycom App. You will find your pay stubs under the Payroll section of the site. For more detailed instructions please review pages 5 and 6 in the attachment located in the side bar of this page.

I think my paycheck is incorrect. What do I do?

If you believe that your paycheck amount does not look correct first check your timesheets by logging into the Paycom website or using the Paycom App.

- Review your timsheets in the Time Management sections of the site to see if all of you punches are correct

- Review your pay stub in the Payroll section of the site to see if all hours were included.

- If you find issues in those areas or need more help reach out to your direct supervisor to help you resolve the issue.

- If additional hours are owed to you your supervisor will reach out to Payroll to get them processed and paid.

My address is incorrect or has changed. How do I update my address?

When you move you need to change your address. The address in your profile is the address that will be on your W-2 and other tax documents. It is also the address where your tax forms and any paper checks will be sent to. To update your address login in to to the Paycom Website or use the Paycom App to update your address.

For more specific instructions view the attachment in the side bar of this page.

What is a Punch Change Request and how do I submit one?

Punch change requests allow you to submit a change on your timesheet to your manager.

They would be used if you missed a punch or if you punched in or out and the incorrect time.

You can submit punch change requests through the Paycom website or the Paycom App. For specific instructions on how to submit a punch change request review the info below. This guide is available for download in the attachments section in the sidebar.

I think my taxes are wrong

Paycom calculates your taxes based on the information you provided, the inconsistencies you're seeing with your federal taxes is probably related to your W-4. The IRS reformed the W-4 in 2020 and it's the biggest change they've made to the form in close to 30 years. I'd recommend checking out this IRS calculator here: https://apps.irs.gov/app/tax-

For more info, IRS Publication 15 comes out each calendar year, which contains tax withholding tables. You can choose to view those or reach out to a CPA/Accountant for detailed information. RAS is able to point people to areas where they can get the correct information to make informed decisions about their checks, but cannot actually provide legal or tax advice to individuals. The only way you're able to get a direct answer from someone on how your taxes were calculated would be to contact a tax professional like a CPA or an accountant.

If you're concerned about how your taxes are being calculated, please consult with a tax professional to see how you can adjust your W-4 within the system to get the outcome you'd like.

How do I update my tax information?

To update your tax information login to the Paycom website or use the Paycom App. Under the Payroll section you can update your tax information.

For more specific instructions view the attachment in the sidebar of this page.

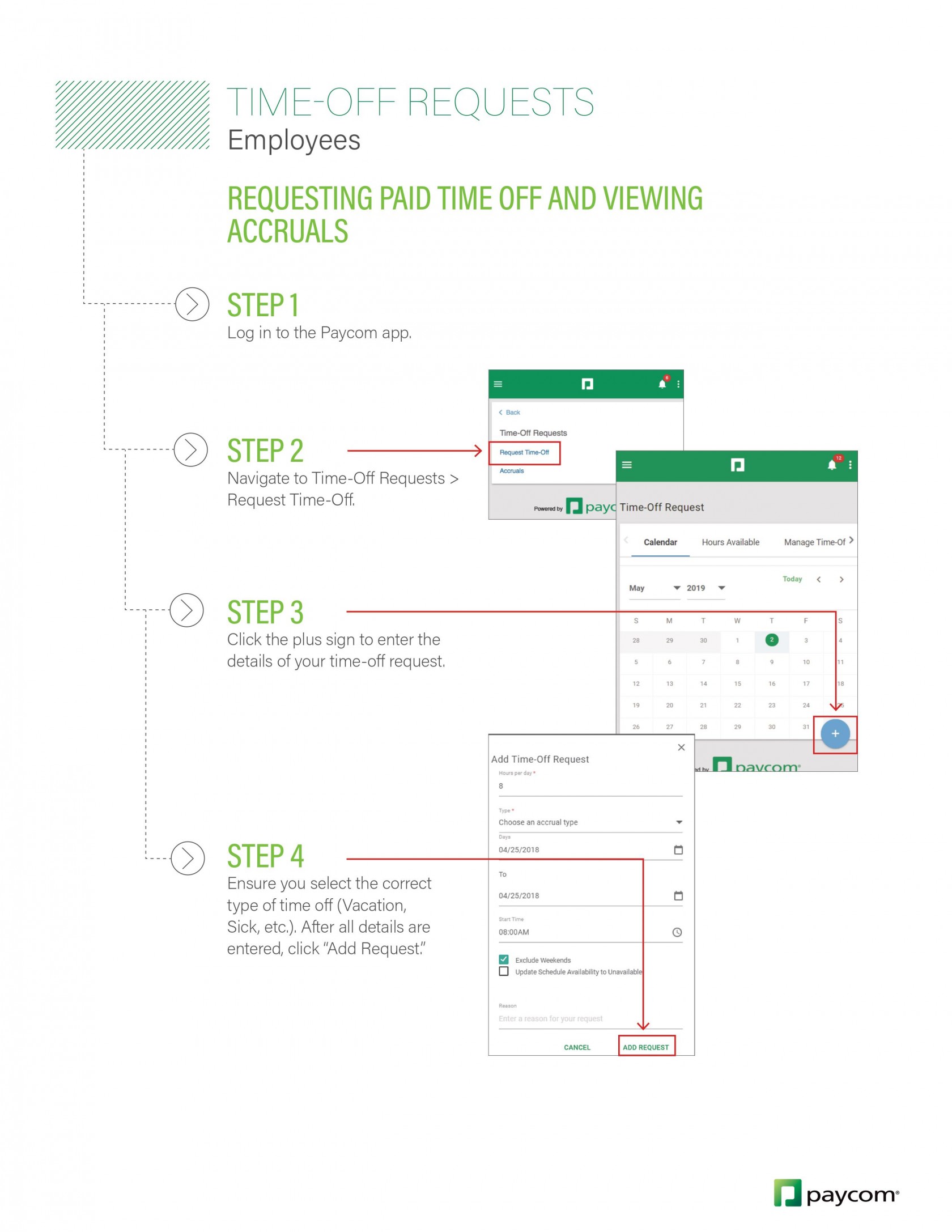

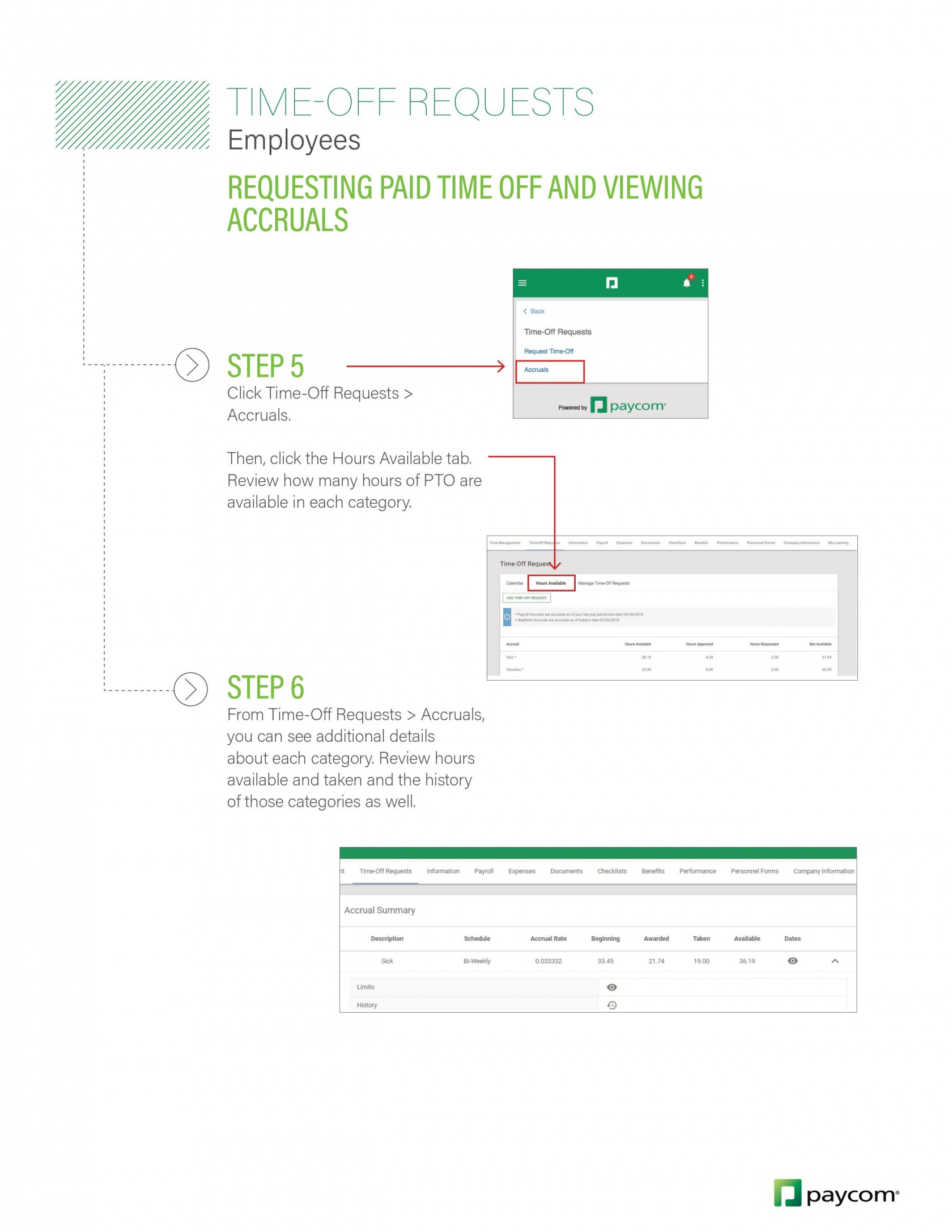

How do I request time off or view how much time off I have?

If you work in a state that provides Sick time off you can view what your current balance is or request to use the time using the Paycom Website or Paycom App.

For specific instructions, view the instructions below. Attachments are available in the side bar of this page.

Paycom Help Videos

Confused on what to do in the Paycom App? Here are some videos that may help you out!

Click to Watch How to Enable Location Services on your iPhone

Click to watch How to Request Time Off in Paycom

Who do I go to for help in Paycom?

In Paycom, you'll actually go to different people for help. Please use the chart below to determine who to direct your question to. This is also available for download as a PDF in the left-hand sidebar. If you are printing this out for your Program Site, please add in your Area Manager, their email, and their phone number to the bottom of this form.

I received an email that told me to approve my timesheet. What does that mean?

In Paycom you have the ability to review and approve your timesheet prior to your manager approving it.

While this is not required it is recommended. By approving your timesheet on the last day of the pay period you will be able to check that no edits are required.

You can review and approve your timesheet using the Paycom Website or Paycom App. For specific instructions refer to the guides below. These are available for download in the sidebar of this page.

2020 Payroll Calendar

2021 Payroll Calendar

This 2021 Payroll Calendar is also available for download (PDF Format) in the side bar.

2022 Payroll Calendar

2022 BW Pay Period & Pay Date Calendar.pdf

2023 Payroll Calendar

2024 Payroll Calendar

2024 PAYROLL INFORMATION